A Rapid Ramp-Up for the Dangote Refinery

Read in 3 minutes

[To read this post with more numbers and detail, clients can click here for the full note and potential clients may contact us here for a free two-month trial with no obligations.]

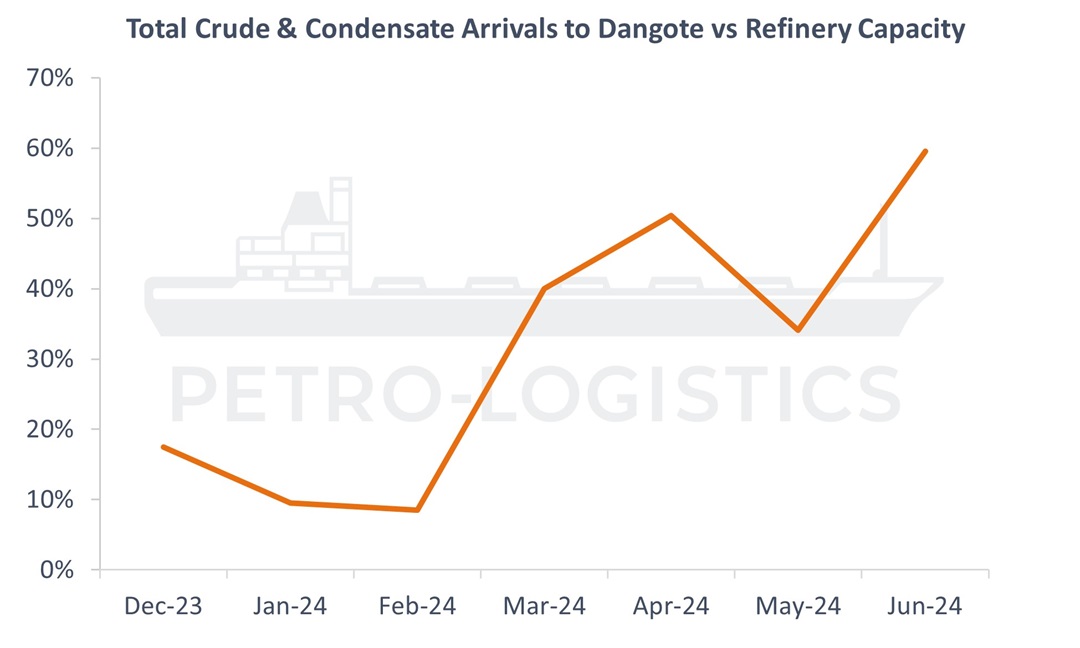

Since first oil was delivered to the newly built Dangote refinery for line and tank-fill in the period December 2023 to February 2024, arriving feedstock volumes have steadily increased, barring a drop in May. Initially run exclusively on Nigerian grades, the refinery started importing WTI barrels in late 1Q24. Whilst NNPC is the main provider of Nigerian barrels, other producing companies in Nigeria have also supplied the plant.

With a CDU capacity of 650 kb/d, crude deliveries represented 34% of capacity for the first six months of 2024, with 2Q24 standing at 48%. Those barrels were not necessarily processed in the month they were delivered, but as volumes increase Dangote appears close to being able to run at 50%, which was the target level of runs for its first year of operation.

Even though Dangote is privately-owned, NNPC is a 7% partner, though this is a reduction from an initial 20% due to NNPC’s failure to pay the balance of their share of costs. There were reports that NNPC had agreed to provide 300 kb/d of feedstock, and the proximity to Nigerian fields raised expectations that most barrels would be sourced from Nigeria.

Since March, however, the refinery has gone beyond Nigeria, regularly importing US barrels. Amidst rumours of payment issues affecting those deliveries, some cargoes were seen anchored off Lagos for over a month before discharging at the refinery. One tanker went from the Lagos area to Abidjan (Ivory Coast), before returning to Lekki to deliver its crude.

Over time, Dangote has become a key buyer of Nigerian crude, taking on average 11% of Nigerian seaborne-loaded barrels (crude and condensate combined) for the period between December 2023 and June 2024. Nigeria was the number one destination country for Nigerian crude & condensate in both May and June.

With the refinery only operating at half capacity, Dangote’s intake of Nigerian barrels will likely increase further as the plant ramps up, expanding its share of the country’s waterborne sales in the context of stagnant export levels.

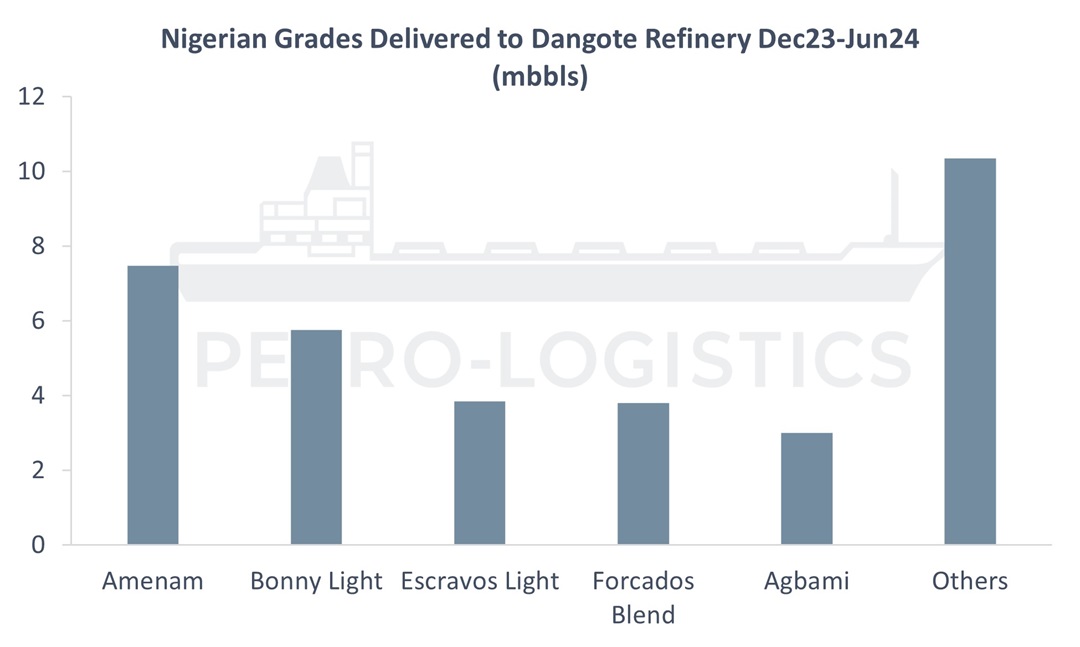

Besides WTI, the refinery has taken an array of Nigerian grades. Amenam has become a staple grade, followed by Bonny Light, Escravos, Forcados and Agbami as the top 5 Nigerian crude and condensate grades taken by Dangote so far.

Dangote is aiming to secure regular WTI supply, potentially through term contracts. High volumes of WTI are projected to arrive in the third quarter as well as at least the one tanker of Brazilian Tupi as the refinery gears up to produce gasoline. The refinery has also approached Libyan producers and suggested that other feedstock could come from Angola as well as other West African producers. Petro-Logistics will continue to inform its clients of crude deliveries to Dangote from Nigeria, the US or any other country.