Beyond War: Could Sanctions Bite Iran Harder?

Read in 3 minutes

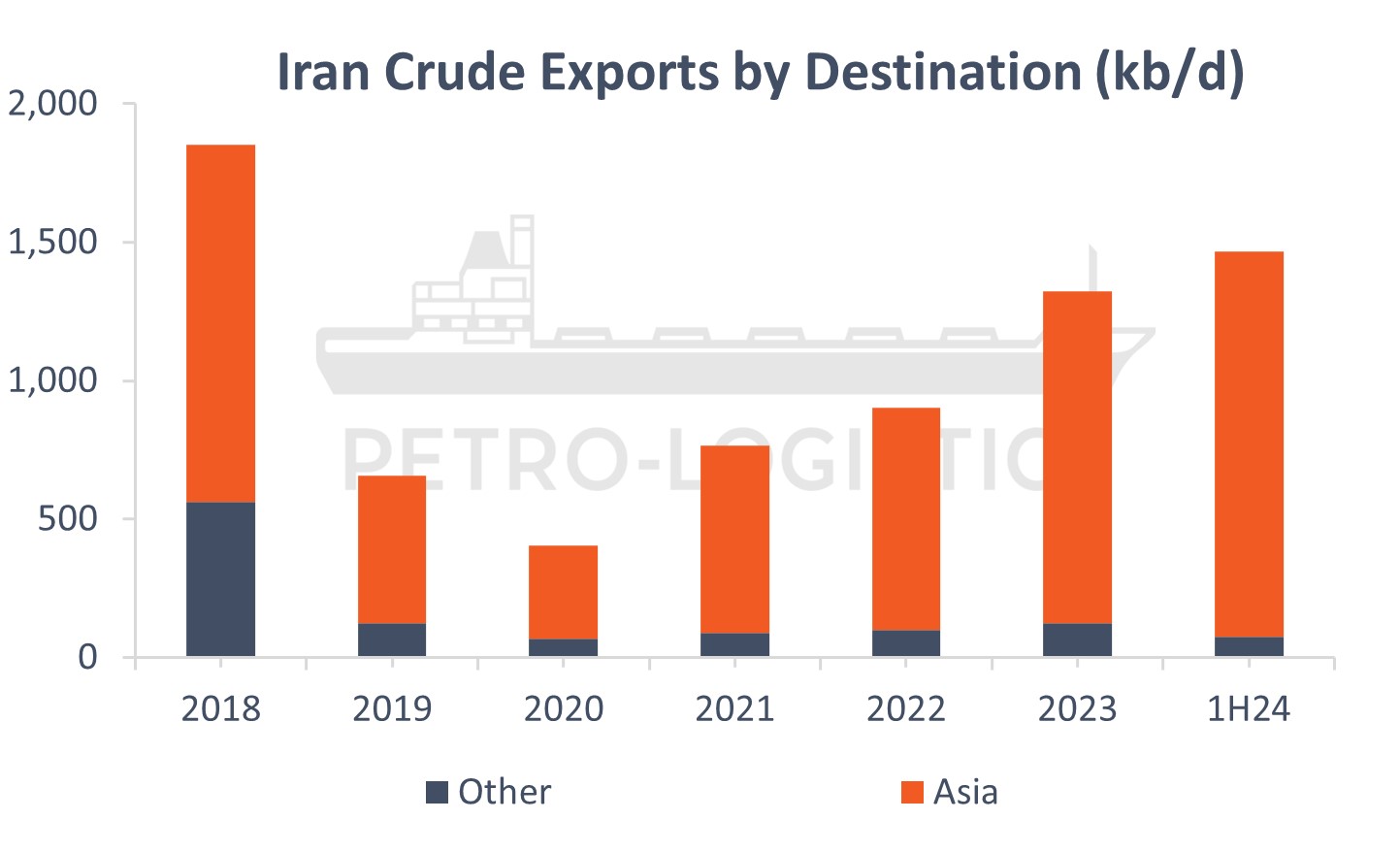

As the possibility of war looms between Iran and Israel, questions have also been raised about whether a renewed push to tighten sanctions could reduce Iranian crude exports regardless of whether war breaks out.

The risk is China-centric as the country has served as the key outlet for Iranian oil. Iranian crude exports to China have steadily grown since the Biden Administration took office, from 0.7 mb/d in 2021 to 1.6 mb/d in 3Q24. 3Q24 witnessed an 0.4 mb/d y/y increase to China, with Chinese purchases accounting for 94% of all Iranian exports.

While sanctions targeting Iran’s oil sector are already in place, there is speculation that Washington could try to squeeze harder, especially on sanctions evasion tactics. The Trump administration was able to reduce Iran’s exports to 0.4 mb/d in 2020, leading some to believe that a determined enforcement effort could again significantly cut volumes.

State-owned Chinese refiners have long since stepped away from purchasing Iranian barrels due to concerns about sanctions exposure arising from their business dealings involving western financial systems. However, independent teapot refiners have stepped into the gap, circumventing sanctions by avoiding the use of US dollars through Renminbi transactions and working with smaller banks that lack exposure to Western markets.

This arrangement means that while Iranian crude sales have been able to continue, Iran’s ability to use its earnings is constrained due to the limited convertibility of the Chinese Yuan. Purchasing Chinese goods or accumulating Yuan-denominated reserves are the only major possible uses of the proceeds.

Teapots, which account for over a quarter of China’s refining capacity, are already absorbing most of Iran’s oil exports. Should tensions in the region ease and Iran manage to increase its exports, the large capacity of the sector means these plants could theoretically increase their intake of Iranian crude if the price discounts remain competitive.

That said, the actual absorptive capacity depends on the ownership structures of the companies. For example, China’s newest independent refinery is the 400 kb/d Yulong refinery which is 51% owned by Nanshan Group, the largest manufacturer of aluminum in China with a diverse portfolio of domestic and international businesses. Such a company would be exposed to sanctions and thus unlikely to buy Iranian oil at any price. While many independent refiners are solely domestically oriented, some teapot capacity is likely exposed to sanctions risk.

Iran’s oil exports to China are unlikely to face immediate collapse in the event of tighter sanctions given the existing transactional mechanisms in place with Chinese teapots. However, it cannot be ruled out that a more aggressive enforcement strategy, particularly one targeting the smaller banks facilitating these transactions, could curb Iran’s exports.

In the near term, military conflict is the greatest worry, especially given that the vast majority of Iran’s crude loading capacity is centered on a small bundle of infrastructure on Kharg Island. But beyond the current round of violence, renewed sanctions efforts bear close watching.

Kharg Island, Iran. Showing crude loading and storage infrastructure. Source: NASA